Imagine this: you are shopping around for a new car insurance policy after purchasing your first car. You have a stable job and have been paying your bills on time, driving safely, and feeling like you have a solid grip on your financial situation. But when you get your car insurance quote, the rates are significantly higher than you expected—despite having a clean driving record. It turns out your credit score was dragging your rates up.

This came as a surprise as you always assumed that your driving history was the only thing insurance companies cared about. But what you didn’t know was that auto insurance companies also factor in your credit score when determining your car insurance premiums. In fact, they often use what’s called a credit-based insurance score, which looks at your credit history, payment history, and how well you’ve managed your credit accounts over the years.

This might seem unfair at first, but it’s a reality many drivers face when shopping for auto insurance. So, does your credit score affect your car insurance rate? In this article we’ll walk you through why insurance companies consider credit scores, how it impacts your premiums, and what you can do to possibly lower those costs.

What is a Credit Score?

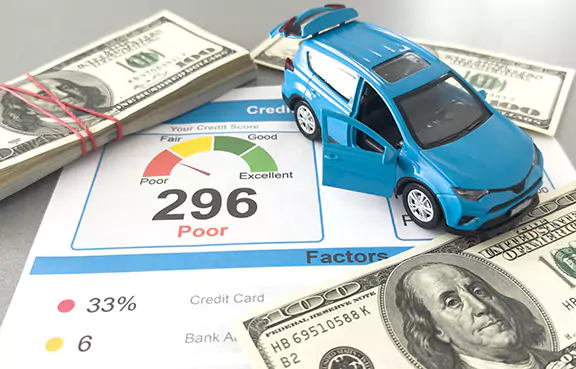

Before we get into how your credit score affects car insurance rates, let’s break down what the term actually means. A credit score is a numerical representation of your creditworthiness based on the information in your credit report. This score is used by lenders, banks, and insurance providers to evaluate how risky you are as a borrower or customer.

The score is calculated based on factors like your payment history, the amount of debt you carry, your credit history length, and the types of credit accounts you have. The most commonly used credit score ranges are:

Excellent (750+): You’re in the top tier of creditworthiness. Lenders love you!

Good (700–749): You’re solid, but maybe not at the top.

Fair (650–699): You might pay higher rates for loans and insurance.

Poor (Below 650): You might struggle to get favorable rates, or you could be charged extra for insurance.

A good credit score often leads to lower interest rates on loans and credit cards, while a low credit score can make it harder to borrow money or get approved for a loan. But it can also play a significant role in how much you pay for car insurance.

What Is a Credit-Based Insurance Score?

When you apply for car insurance, your auto insurance provider typically won’t look at your traditional credit score. Instead, they use a slightly different calculation called a credit-based insurance score. This score is similar to your credit score, but it’s specifically designed for insurance companies to predict how likely you are to file an insurance claim.

The credit-based insurance score is often composed of factors such as:

Payment history (how often you pay bills on time)

Total debt (how much debt you have compared to your available credit)

Length of credit history (how long you’ve had credit accounts)

New credit accounts (how often you open new credit lines)

The key difference between a credit score and a credit-based insurance score is that the insurance score is more focused on predicting financial behavior and risk, rather than whether or not you can pay off your debt.

How Do Auto Insurance Companies Use Credit Scores?

Car insurance companies use credit-based insurance scores to assess the risk of insuring you. The idea is that people who manage their finances well—such as paying off debt on time and maintaining a good credit history—are statistically less likely to file insurance claims. On the other hand, people with poor credit scores may be seen as higher risk because they have a history of financial instability.

Here’s a simple example: Let’s say you have a history of missing credit card payments, which results in a poor credit score. Insurance companies might interpret this as an indicator that you could be financially irresponsible in other areas, like keeping up with your car insurance premiums or maintaining your car.

Insurance companies take a variety of factors into account when determining auto insurance rates, and your credit score is one of the key components. That means that even if you have a clean driving record, a poor credit score can lead to higher car insurance rates.

How Much Does a Poor Credit Score Affect Your Car Insurance Rate?

The impact of a poor credit score on your car insurance rates can vary significantly depending on the insurance company and the state you live in. Some states, like California, Hawaii, and Massachusetts, have laws that prohibit car insurance companies from using your credit score as a factor in determining your auto insurance rates.

However, in most states, auto insurance rates can be significantly higher if you have a poor credit score. According to research by the Consumer Federation of America, drivers with poor credit scores could pay as much as 59% more for car insurance compared to drivers with good credit.

For example, let’s say your credit score is in the 600s (fair or poor). You might see auto insurance premiums increase by hundreds of dollars annually when compared to someone with an excellent credit score.

Real-Life Example: How Credit Scores Affect Car Insurance Premiums

Take David, for example. David has a credit score of 720, which is considered good. He’s shopping for full coverage car insurance and gets quotes from several auto insurance companies. He finds that his premiums are around $1,200 per year for comprehensive coverage.

However, when David’s friend Mark—who has a credit score of 540—shops for insurance, his quotes are much higher. One insurance company quotes him $1,800 per year for full coverage car insurance, while another offers $2,000 annually. That’s a difference of up to $800 or more per year, just based on their credit-based insurance scores.

The Link Between Credit Scores and Risk

The reason insurance companies care about your credit score is simple: they want to predict risk. If you’ve consistently shown the ability to manage debt responsibly, insurance companies view you as less likely to engage in risky behaviors, such as filing frequent claims. Conversely, if you have a poor credit score, insurance companies may see you as a higher risk and charge you higher premiums to offset that risk.

Can You Improve Your Credit Score to Lower Your Car Insurance Rates?

The simple answer is YES! Improving your credit score can potentially lower your car insurance premiums. Here’s how:

Pay Your Bills on Time

The most important factor in your credit report is payment history. Set up automatic payments for your bills, including your car insurance, so you never miss a due date.

Pay Down Debt

Reducing your overall debt—especially credit card debt—can improve your credit score and, by extension, your auto insurance rates.

Check Your Credit Report for Errors

Errors in your credit report can drag down your score. Regularly check your report from the major credit bureaus (Equifax, Experian, and TransUnion) for any inaccuracies.

Avoid Opening New Credit Accounts

Each time you open a new credit account, your credit score takes a small hit. If you’re planning to apply for car insurance, try to avoid opening new credit accounts in the months leading up to it.

Does Insurance Have to Be More Expensive with Poor Credit?

Not necessarily. If you have a poor credit score, it might mean higher car insurance premiums, but there are ways to mitigate this. One option is to shop around and get quotes from multiple car insurance companies. Rates can vary widely between insurers, and one company might be more lenient with people who have poor credit scores.

Additionally, some auto insurance companies offer discounts for things like bundling policies (if you have home insurance as well) or maintaining a clean driving record. Don’t assume that you’re stuck with the highest possible rates just because of a poor credit score.

What If You Have No Credit History?

If you have no credit history—perhaps you’ve just moved to the country, or you’re new to credit—car insurance companies might still use other factors to determine your car insurance rates. Some auto insurance companies offer “no-credit” policies, though these might come at a higher cost.

However, establishing a solid credit history can lower your rates over time, so it’s still a good idea to build credit in the long run.

Can You Get Insurance with Bad Credit?

Yes, you can still get car insurance with bad credit. Many car insurance companies offer policies to individuals with poor credit scores. However, you may face higher auto insurance premiums and fewer options for coverage.

If you have poor credit, it’s a good idea to speak with an insurance agent who can help you find an insurer that is more likely to work with you. You may also want to consider minimum coverage car insurance as a temporary solution to lower your rates.

Can Insurance Companies Deny You Coverage Because of Your Credit Score?

In most cases, auto insurance companies won’t deny you coverage because of your credit score. However, your car insurance premiums may be significantly higher if you have poor credit. Some states have regulations to protect consumers from being denied coverage outright based on credit, but in general, your credit score will only affect how much you pay, not whether or not you’re covered.

Can Insurance Companies Deny You Coverage Because of Your Credit Score?

So, does your credit score affect your car insurance rate? The short answer is: yes, it does. If you have a poor credit score, you’re likely to pay higher car insurance premiums. However, the good news is that improving your credit score over time can help lower your premiums and make insurance more affordable.

The key is to shop around, maintain a good credit history, and explore different car insurance companies to find the best deal. A little effort can go a long way in saving you money on your auto insurance—even if your credit score isn’t perfect.

Take Control of Your Car Insurance Rates—Act Now!

Now that you know how much your credit score can impact your car insurance rates, it’s time to take action. If you have a poor credit score, don’t let it cost you more in premiums than necessary. Start by reviewing your credit report, paying down debt, and improving your credit score over time. A higher credit score can directly lead to lower auto insurance premiums.

But you don’t have to wait to shop for better rates. Auto insurance companies may charge higher rates based on your credit-based insurance score, but with the right approach, you can still find affordable coverage. Take the time to compare car insurance companies, get multiple quotes, and ask about any discounts that could help offset the higher premiums due to your credit score.

If you’re unsure where to start, contact an insurance agent who can guide you through the process and help you explore options that fit your financial situation. Don’t let a poor credit score hold you back—start taking control of your car insurance costs today. By shopping around, improving your credit score, and making informed decisions, you can reduce your rates and protect yourself on the road without breaking the bank. Reach out now to find out how much you could save!