If you’re new to the United States and only just started a job, it can be tough to figure out all the different items listed on your payslips. While it may seem confusing at first, it is important that you know how to read a pay stub, which shows you how much money you have earned and what were taken out for taxes and other things. Even if you’ve never seen a pay stub before or don’t understand some of the words on it, don’t worry! In this blog post, we’ll explain step-by-step how to read a pay stub so that you can be sure you’re getting paid the right amount.

Getting your first paycheck or pay stub in the U.S. is an exciting moment for a new immigrant. Your employer — provided that you are starting with a temp agency or a permanent position with a company — may issue your first paycheck in the form of a physical paper check while the direct deposit is being set up. It’s important you review your check to confirm the correct amounts are being deducted. If you are already receiving your payment as a direct deposit, be sure to log in to your account and check as well. It is your responsibility to make sure the correct amount of taxes are being deducted. Just as important is checking your benefits, such as a 401K or health insurance, are being deducted so you and your family are covered.

Let’s take a look at the components of a pay stub so that you understand what everything means and how it affects your paycheck.

What is Your Pay Period?

The first thing to check is the pay period covered by the pay stub. You’ll find this near the top of the paycheck. If you are an hourly employee, the pay will most likely be for the previous week or two depending on how often you are paid. So if you had a lot of overtime, don’t rely on that money to arrive the same week you complete it. It will most likely be paid on the following pay period.

Gross and Net Pay Section

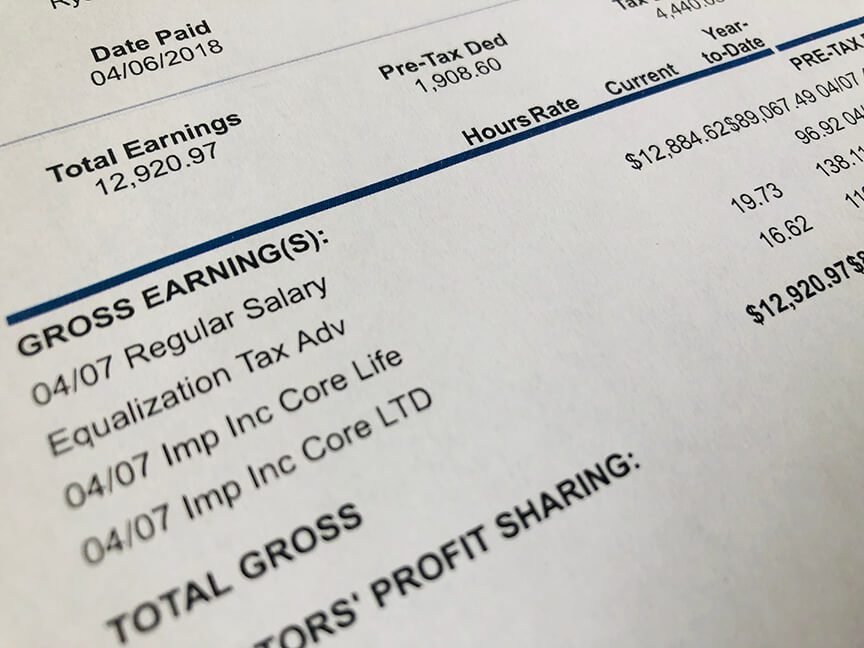

Your current payment for the pay cycle (weekly, biweekly, semi-monthly or monthly) is typically displayed on top of your earnings statement and can be conveniently understood.

The information you will observe in this section relies upon whether you are a salaried worker or an hourly wage earner.

If you’re earning wages by the hour, it will consist of your per hour rate together with the number of hours worked during that period; overtime hours may also be listed. For annual salary earners, what’s expected to appear is their income over that specific payment period plus any extra bonuses they might have received.

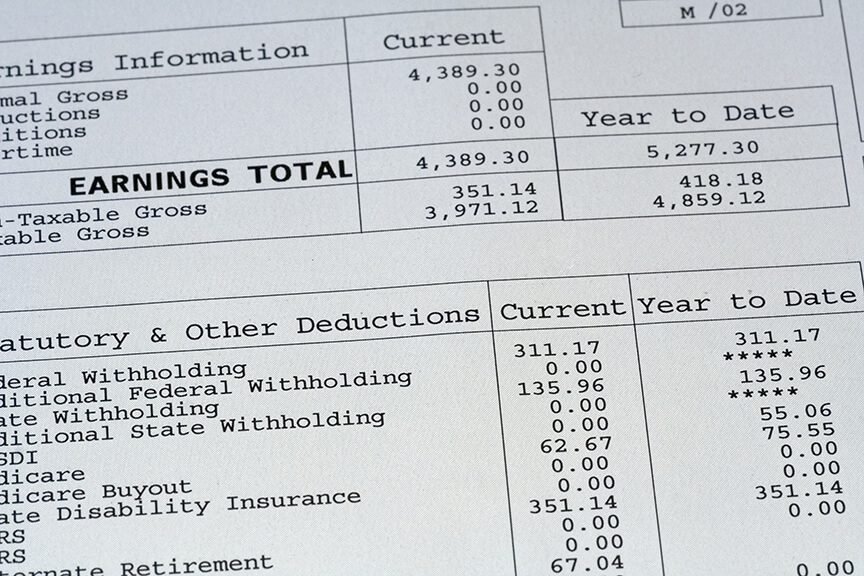

There are three lines to focus on:

- Gross Income/ Earnings – Amount before any taxes or deductions

- Year-to-Date (YTD) Gross reflects everything that’s been paid to you since the beginning of this year, and

- Net Pay – the amount that is actually being paid to your account or written on the check for you to deposit

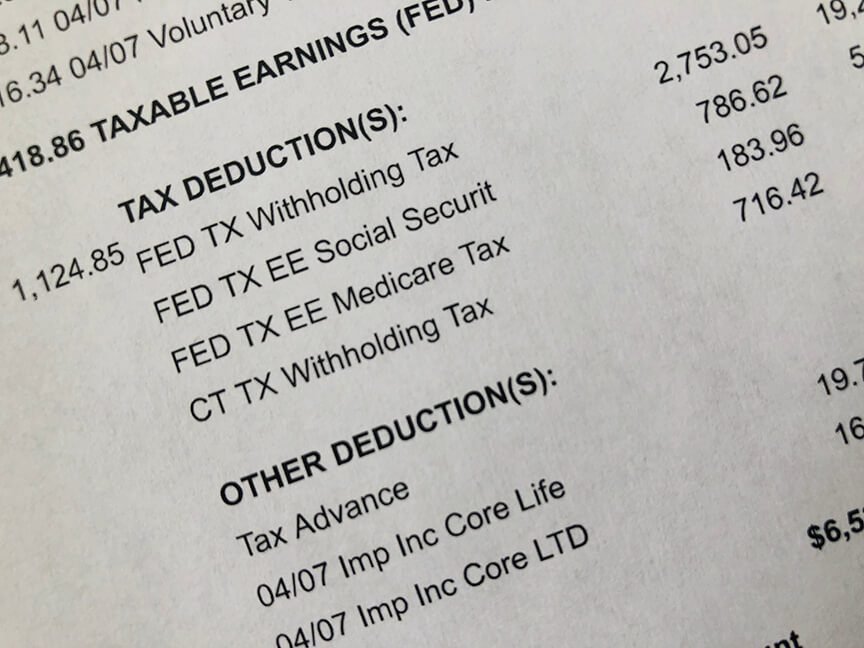

Your Taxes

The taxes you pay are often the most difficult part of your paycheck to understand. The amount of taxes you pay depends on where you live, how many people depend on you and where you get paid. Different states have different tax rates. So if your work is in a state different from where you live, the amount of taxes that come out of your paycheck may change. There are 3 main types of tax that will usually be on your pay stub.

Federal Income Taxes

The Federal government withholds a portion of your salary each year. The amount of Federal income tax depends on how much you make, the number of dependents you have and other factors.

When you first start a new job you’ll be asked to fill out a W-4 form so your employer can calculate the correct withholdings for each paycheck. These are the tax withholding you will see on each paycheck.

Sometimes, the government takes too much or too little money from your paycheck for taxes. This can happen if you start a new job or have a baby, for example. If something like this happens to you, it’s important to tell the IRS or the people who handle HR at your work right away.

If you have pay too much tax, you’ll receive a refund after filing your taxes in April. By contrast, if you pay to little, you will owe money and may be required to pre-pay estimated taxes for the next year.

State and Local Taxes (SALT)

You may also see some money being taken out of your paycheck for state income tax. Every state has a different rate for these taxes. Some states, like Florida and Texas, don’t have any state tax at all. If you do have to pay state tax, it’s calculated in similar way to federal tax.

In some places, you may also have to pay a local income tax, though not every city or town does this. If your city does have a local income tax, they will take out a certain amount from each paycheck that you get.

This amount of taxes should stay the same as long as you keep making the same amount of money.

Federal Insurance Contributions Act (FICA) - Social Security and Medicare Benefits

In the U.S., everyone who pays taxes has to give some money to Social Security and Medicare. As an immigrant to the U.S., these programs are designed to provide income and health care at age 65. To receive the full benefits a person must have worked and paid into FICA for 40 quarters (10 years).

This is called FICA. When you get paid, a certain amount of your paycheck goes into these programs.

The amount that you have to pay depends on how much money you make. For Social Security, you and your employer each contribute 6.2% of your income if you work for someone else. If you work for yourself, then you have to pay the full 12.4%.

For Medicare, everyone pays 1.45% of their income, and their employer pays another 1.45%. There’s no limit on how much money this applies to – it’s just a percentage of what you earn. If you’re self-employed, then you have to pay both parts which add up to 2.9%.

Other Deductions on Your Pay Stubs

On top of taxes, your paycheck is likely to contain a multitude of other deductions that will inevitably reduce the amount you take home. These may be located in the same area as taxes on your paystub. Although it’s not possible for us to list all these tax reductions here, it is essential for you to comprehend each one listed on your wage slip. Should any deduction remain unclear, feel free to reach out and talk with your employer without hesitation! Here are the most common ones:

Insurance

If you get health insurance from your job, you should see it on your paycheck. Sometimes, it might say “pretax” next to it. This means that the money for your insurance is taken out of your paycheck before taxes are taken out. That way, you won’t have to pay taxes on that amount.

The word “insurance” on your paycheck can mean different things. Examples are medical or dental insurance, life insurance, or disability insurance. It’s important to know what kind of insurance you’re paying for so you understand what’s covered if something happens.

When you start your employment (either immediately or after a probationary period), you’ll receive information about your open enrollment period. This is the time when you are allowed to select various insurance options for you and your family that your employer offers.

Please note: If both you and your spouse are working, it’s important to make sure you are not taking too many deductions or have overlapping coverage.

Flexible Spending Accounts and Health Savings Account

Health savings accounts (HSAs) and flexible spending accounts (FSAs) are two programs that help people with health insurance save money for medical expenses. HSAs are for people who have a high-deductible health plan. When you put money into an HSA or FSA, you don’t have to pay taxes on it.

You can use the money in your account to pay for things like doctor visits or medicine. This way, you don’t have to pay for everything out of your own pocket. If you’re in one of these programs, the amount of money you put into your account will show up on your paycheck.

Taking advantage of a Dependent Care FSA allows you to make tax-free withdrawals for approved childcare expenses. Your income statements may include the deductions that show up as savings in your paycheck each month.

Retirement Savings Plans

When you get paid, some of your money might go towards a retirement plan. This means that you’re putting money aside for when you retire and stop working. There are different types of retirement plans, like traditional IRAs, Roth IRAs, SEP IRAs, and 401(k)s.

When you sign up for a retirement plan, you have to decide how much money you want to put in. This is a percentage of how much money you make before taxes are taken out. Then, this amount is taken out of your paycheck so it can go into your retirement account.

Depending on the type of retirement plan, these withdrawals will be pre-tax contributions or post-tax.

The Financial Importance of Understanding Your Pay Stubs

In conclusion, understanding your pay stub is an important part of managing your finances. By knowing how much money you’re making, what deductions are being taken out, and what those deductions mean, you can make informed financial decisions.

By taking the time to understand your pay stub, you’ll be better equipped to manage your money and to make informed financial decisions.