If you are a victim of identity theft, don’t panic. There is help available. In this blog post, we will discuss the various types of identity theft victim assistance available to immigrants and anyone else in the U.S. Learn how to protect yourself from becoming a victim.

No matter if you just arrived or have been an immigrant in the U.S. for years, you can be targeted for identity theft. Identity theft is a crime where someone uses your personal information without your permission to commit fraud or other criminal acts.

What is a key indicator of identity theft?

When you start to receive phone calls or emails requesting you to confirm purchases, prescriptions, or personal information, you may be the target of a phishing scam or already a victim of identity theft.

Some common types of identity theft include:

- Financial Identity Theft

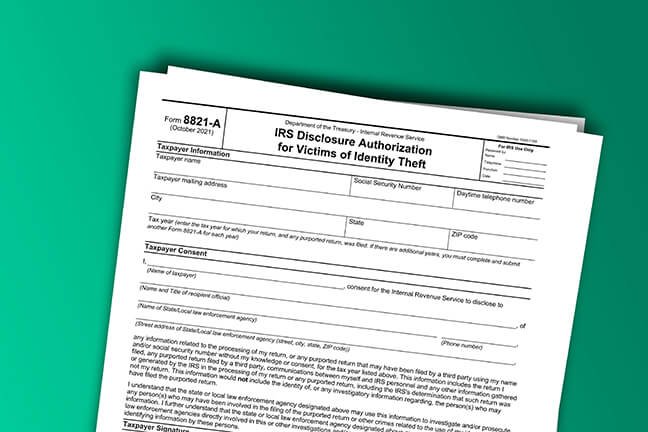

- Tax Related Identity Theft

- Criminal Identity Theft

- Medical Identity Theft

Being new to the U.S. immigrants are targeted more often for these types of theft because of a lack of knowledge of the types of online and email scams. Thieves are constantly trying to get access to your

- Social Security Number

- Driver’s License Number

- Bank Statements

- Medical Insurance Documents

- Tax Returns

- Your Birth Certificate

Any one of these documents could be used to commit identity theft.

What are The Rights of Victims of Identity Theft?

The Identity Theft and Assumption Deterrence Act of 1998 (ITADA) grants victims of Identity Theft the right to have fraudulent records removed from their credit report. Victims also have the right to file a complaint with the police, receive free copies of their credit report and dispute any incorrect information on it.

What are the Steps to Take if You are a Victim of Identity Theft?

Fraud-Alert Notice

Place a 1-year Fraud Alert on your account at one of the three major credit agencies. That company will notify the other two agencies.

The three major credit reporting agencies are:

Check Your Credit Report

Checking your credit report too often can be a red flag for Identity Theft. However, you should pull your credit report at least once a year and look out for signs of Identity theft such as new accounts opened in your name or balances that you have not authorized.

If you are reporting a fraud alert notice you will not be penalized for running a credit check even if you have just done one.

File an Identity Theft Report with Your Local Police Department

Go to your local police department and file a police report.

Contact All Your Financial Institutions

This includes banks, credit card companies, and loan companies to notify them of potential fraud and monitor your accounts, change credit card numbers and close suspicious accounts.

File a Complaint with the Federal Trade Commission

The Identity Theft Victims Assistance page on the FTC website provides you with further helpful information as well as an Identity Theft Affidavit to file with other creditors and businesses.

What Identity Theft Resources Are Available for Immigrants?

The good news is that there are organizations and government agencies that can help you if you are a victim of identity theft. The FTC Identity Theft Website provides a comprehensive Identity Theft Recovery Plan as well as information on how to protect yourself from becoming a victim in the future. You can start the process online with the FTC or do it yourself by following their step-by-step guides.

The three major credit reporting companies can provide guides for you to follow.

Be Wary of Fraud Victim Assistance Phone Calls

If you suspect fraudulent accounts have been opened in your name and suddenly start receiving calls from companies claiming to provide free credit reports or file a police report on your behalf of potential fraud, hang up. This is most likely the identity thief trying to get more sensitive information about you.

If you are unsure what to do, contact the FTC, credit companies and your financial institutions directly for help. Don’t login to financial institutions from emails you receive.

How to Prevent Identity Theft?

As an immigrant, you need to be extra careful when it comes to identity theft. Identity theft doesn’t just come from strangers. Friends and family can also be to blame. Identity theft can be prevented with a few simple steps:

- Securely store your personal documents, such as Social Security cards and passports.

- Always be aware of your surroundings when using public Wi-Fi networks, as these are a popular target for identity thieves.

- Be cautious when providing your information online or over the phone.

- Finally, monitor your financial accounts regularly for any suspicious activity or errors.

- Check your credit report

- Change passwords regularly

Buy a Heavy-Duty Shredder for Your Home

This one tool is not commonly listed on sites telling you how to prevent identity theft but it’s a simple solution to reducing your chances of having your identity stolen.

Buy a shredder that “crosscuts” unwanted mail and bank statements into tiny pieces, not just strips like low-end shredders. These shredders can do many pages at once, thicker unopened “credit card approval notices” or old credit cards as well.

It’s a small investment to protect yourself.

Additional Identity Theft Protection Services

There are Identity theft protection services that offer a variety of features such as fraud alerts, credit report monitoring and data breach notifications to monitor your personal information for fraudulent activity. These services do a great job of constantly looking for patterns that may be the beginning steps of potential identity theft.

Some of the best highly rated theft protection services include: